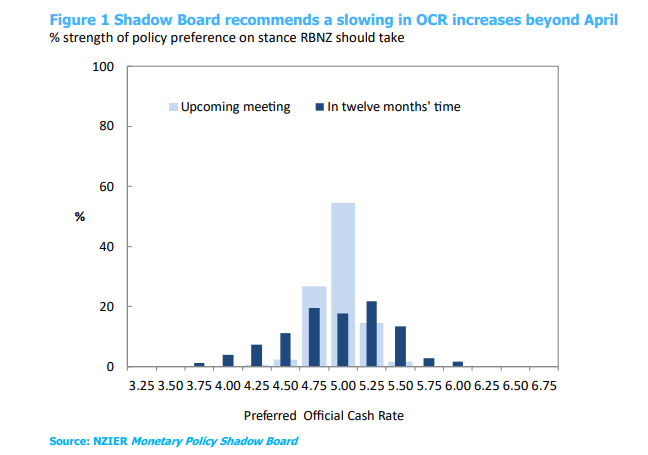

Shadow Board recommends a smaller OCR increase of 25 basis points by the Reserve Bank in April

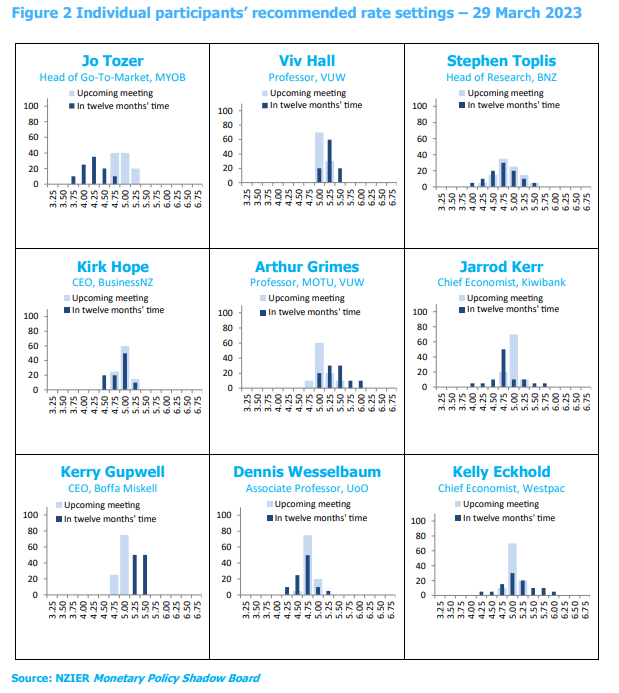

Shadow Board members recommend a smaller hike in the Official Cash Rate (OCR) in the Reserve Bank’s upcoming April Monetary Policy Review. The majority view was an OCR increase of 25 basis points, given inflation pressures are still high in the economy and inflation expectations remain above the Reserve Bank’s 1–3 percent inflation target band. However, two Shadow Board members recommended the Reserve Bank keep the OCR unchanged at 4.75 percent. One of these members considered the OCR should have already peaked, while the other highlighted the increased risk of a recession looming.

Regarding where the OCR should be in a year, the Shadow Board’s core view ranged from 4.25 percent to 5.50 percent. The broad consensus was that the Reserve Bank should be careful with further tightening beyond April. Some members recommend the Reserve Bank pause with OCR increases after April but keep it elevated for some time to bring inflation down. Amongst those members, one pointed out that previous OCR increases are already dampening demand in the economy, and the increased risk of a banking crisis may heighten the risk of a recession. There was one Shadow Board member in the business community who viewed the OCR should be lower in a year, given business profitability and finances are already hard hit by the interest rate increases to date.

Table 1 Participant comments

| Stephen Toplis | We don’t think further tightening is necessary. But equally, we expect the RBNZ to raise rates again at the upcoming meeting. Whichever way you look at it, the peak is nigh. But rates are probably going to remain elevated for some time if the RBNZ is to achieve its stated objectives. And the neutral rate keeps rising. |

| Viv Hall | 2-year CPI inflation expectations remain persistently above the 1-3% range, employment remains significantly above its maximum sustainable level, and there is insufficient preliminary evidence of core inflation trending downwards. A further increase in the OCR of at least 25 bp is required now, and possibly another 25 bp during the next 12 months. |

| Kirk Hope | No comment. |

| Jarrod Kerr | We expect inflation to come off quite quickly this year, and next. We believe central banks have done enough to change the course, and the downside risks to growth are coming through. Unfortunately, inflation is proving to be more persistent near term. But the tide has turned. A banking crisis of any magnitude trumps inflation. Recessions kill inflation pretty quickly. And any financial crisis that induces a severe restriction in credit creation will cause a messy recession. Inflation will be forgotten in such an environment. We believe the RBNZ should hike to 5% and pause. Enough is enough, and the RBNZ has done more than enough. The risk is clearly tilted to move hikes more than we expect. The RBNZ are hell-bent on breaking the back of the inflation beast, with their thoughts centred around a 5.5% terminal rate. That would be a step too far and cause a deeper recession than they forecast. |

| Jo Tozer | Rising costs and cautious consumer spending are hitting businesses hard. MYOB’s 2023 Business Monitor reveals 45% of SMEs saw their profitability decline in the last three months and revenue for the past 12 months is down for 1/3 of local operators. Over a third of the SMEs concerned about the impact of rising interest rates on their business finances, said they’d need to dip into their personal finances for their business if interest rate increases continue. |

| Arthur Grimes | Decisions are tough for a central bank when making up for egregious errors over recent years. |

| Kelly Eckhold | Inflation may prove to be very persistent, making it more likely that the OCR needs to move higher and stay there for at least a year. There are some risks that the expected slowdown in growth and the labour market allows for some easing by the end of 12 months – but the data needs to prove this and so far has not convincingly. |

| Kerry Gupwell | Inflation remains persistently high, so another increase is warranted. Labour shortages persist, which means ongoing pressure on labour costs. Now starting to see/hear signs of company failures and some “downsizing”. |

| Dennis Wesselbaum | GDP and job openings (skilled & unskilled) are falling, unemployment, mortgage repayment deficiencies, and PPI (at a much slower rate) are increasing, and the Cyclone Gabrielle recovery efforts call for keeping the OCR unchanged. Inflation expectations and CPI inflation will be too high, calling for a small increase. Overall, with a looming recession (lags) and recovery efforts, I would keep the OCR unchanged. |

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 22 May 2023, ahead of the RBNZ’s Monetary Policy Statement. Past releases are available from the NZIER website: www.nzier.org.nz

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969

Share this

Related publications

Shadow Board recommends the Reserve Bank increases the OCR by 50 basis points in February

Shadow Board recommends the Reserve Bank hold the OCR at 5.50 percent in October