NZIER’s QSBO shows signs of capacity pressures easing in the New Zealand economy - Quarterly Survey of Business Opinion, April 2023

New Zealand Institute of Economic Research (Inc)

Media release, 4 April 2023

NZIER Quarterly Survey of Business Opinion

Embargoed until 10 am 4 April 2023

The latest NZIER Quarterly Survey of Business Opinion (QSBO) showed some positive developments, with both business confidence and firms’ own trading activity recovering slightly from the weak level seen in the December quarter. The survey also indicated signs of capacity pressures easing in the New Zealand economy as demand further weakened in the first quarter of 2023. This suggests that the increases in the Official Cash Rate (OCR) by the Reserve Bank since November 2021 have started to have a more apparent impact on dampening demand in the economy.

In the March quarter, a net 61 percent of businesses expect a deterioration in general economic conditions over the coming months on a seasonally adjusted basis. This was a slight recovery from the weakest level seen for this indicator in the previous quarter. Firms’ own trading activity also saw a slight improvement, though a net 10 percent still reported a decline in the March quarter. More recently, the December GDP release showed a 0.6 percent decrease in economic activity over the quarter. We expect the disruptions from the floods and Cyclone Gabrielle earlier this year to further weigh on economic activity in the short term.

Weakening demand has become a key concern for businesses

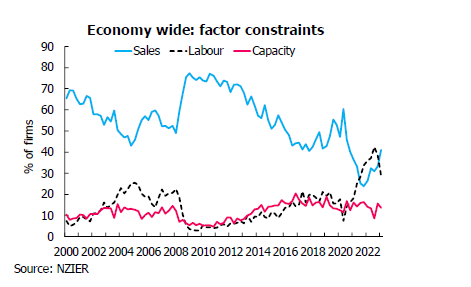

The survey showed signs of a weakening in demand more broadly. Sales have now overtaken finding labour as the top primary constraint for businesses. International border restrictions since the COVID-19 pandemic outbreak led to acute labour shortages, given many firms were no longer able to bring in workers from overseas. The relaxation of international border restrictions has helped to alleviate labour shortages, and we expect labour shortages to ease further over the coming year.

41 percent of firms now report sales as the primary constraint for their business – greater than the 29 percent of businesses reporting finding labour as their primary constraint in the March quarter. These developments point to demand and capacity pressures easing in the New Zealand economy.

Inflation indicators look mixed. While the March quarter saw a considerable decrease in the proportion of businesses reporting higher costs in the March quarter, the proportion which increased their prices increased slightly. Nonetheless, the weakening demand has flowed through to a further deterioration in business profitability, with over half of firms surveyed reporting a decrease in their profits over the March quarter.

Building sector remains the most downbeat as demand continues to weaken

The building sector remains the most downbeat among the sectors surveyed, with a net 76 percent of firms expecting a worsening in general economic conditions over the coming months. The dampening effect of interest rate increases on demand is more pronounced in the building sector, with a substantial decrease in the sector’s new orders and output.

The architects’ measure of activity in their own office points to a further decline in the pipeline of housing and commercial construction work over the coming year. In contrast, the pipeline for Government construction work has rebounded. These results point to a continued easing in residential and commercial construction activity over the coming year, while the post-cyclone rebuild is expected to bring a solid pipeline of Government construction work beyond 2023.

The retail sector is also feeling downbeat. A net 70 percent of retailers expect economic conditions will deteriorate over the coming months. Recent activity indicators show a slowing in retail spending. We expect this to continue as many households rein in discretionary spending in the face of significantly higher mortgage repayments over the coming year. This lagged transmission of higher interest rates in dampening demand in the broader New Zealand economy should become more apparent later this year.

For further information, please contact:

Christina Leung

Principal Economist & Head of Membership Services

Ph +64 21 992 985 | Email christina.leung@nzier.org.nz

Background

The New Zealand Institute of Economic Research has conducted its Quarterly Survey of Business Opinion since 1961. It is New Zealand’s longest-running business opinion survey. Each quarter we ask around 4,300 firms about whether business conditions will deteriorate, stay the same, or improve. The responses yield information about business trends much faster than official statistics and act as valuable leading indicators about the future state of the New Zealand economy. Long term series derived from the survey are held at the NZIER and are available to NZIER members via our website at www.nzier.org.nz.

Share this

Related publications

NZIER’s QSBO shows a cut-back in optimism amongst businesses, Quarterly Survey of Business Opinion - October 2025

NZIER's QSBO shows improved sentiment while actual activity remains soft, Quarterly Survey of Business Opinion - January 2025