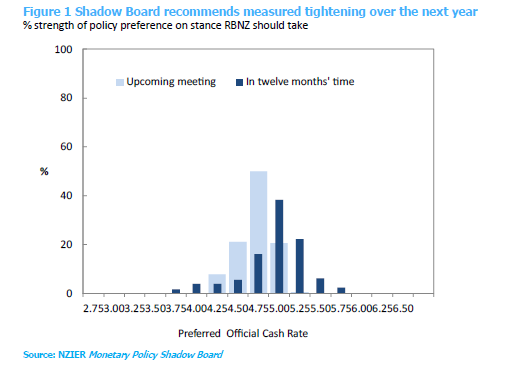

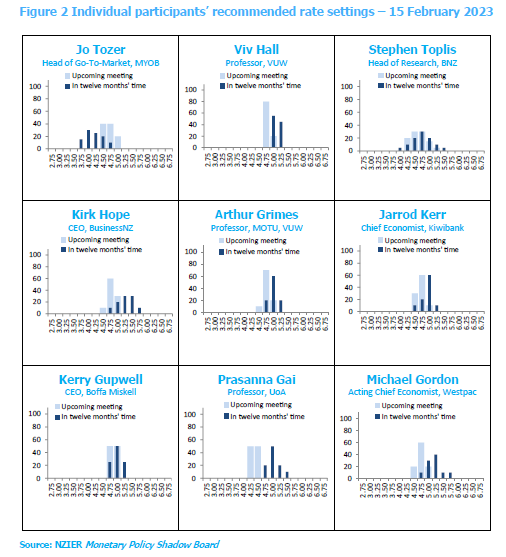

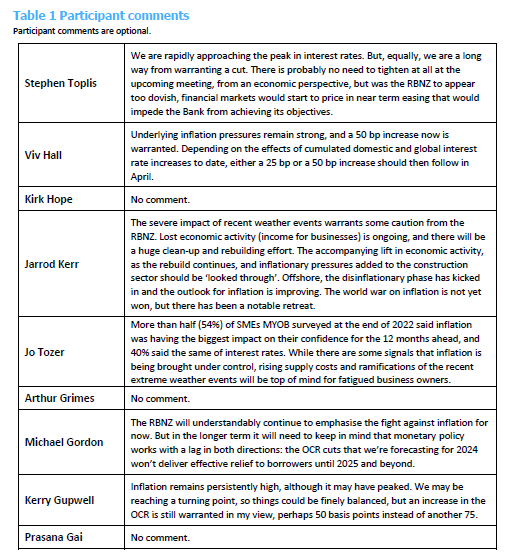

Shadow Board members recommend that the Reserve Bank continue increasing the Official Cash Rate (OCR). The broad view was a 50 basis-points increase in the OCR at the Reserve Bank’s February meeting, given inflation pressures in the New Zealand economy remain strong. Only one member recommended a smaller increase of 25 basis points. Some members also noted that while inflation and interest rates in New Zealand are approaching their peaks, the Reserve Bank should commit to controlling inflation.

Regarding where the OCR should be in a year, the Shadow Board recommends the Reserve Bank takes a more measured approach, with the core views ranging from 4.00 percent to 5.50 percent. One member suggested that the degree of further tightening depends on the effects of cumulated domestic and global interest rate increases to date. Another member highlighted the need for the Reserve Bank to be cautious of over-tightening as monetary policy works with a lag in either direction. Some members pointed out that inflation in New Zealand is reaching its turning point, similar to other countries. However, they also suggested the Reserve Bank should carefully consider the potential for a further rise in cost pressures, particularly in construction, due to the recent extreme weather events in the North Island.

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 3 April 2023, ahead of the RBNZ’s Monetary Policy Review. Past releases are available from the NZIER website: www.nzier.org.nz

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

• encourage informed debate on each interest rate decision

• help inform how a Board structure might operate

• explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969