New Zealand Institute of Economic Research (Inc)

Media Release, 10 am Monday, 2 October 2023

For immediate release

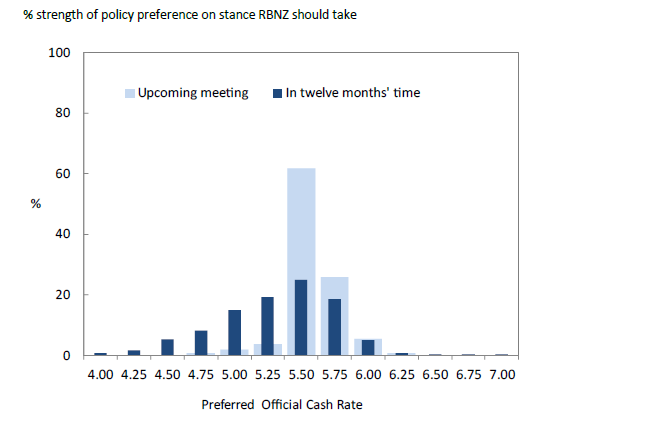

Most Shadow Board members recommended the Reserve Bank should hold the OCR at 5.50 percent in the upcoming October Monetary Policy Review. The full impact of interest rate increases has yet to be transmitted to the broader New Zealand economy. Two members recommended a 25 basis-point hike in the OCR in October. The view was that, with upside risks to inflation appearing more crystalised recently, the Reserve Bank should increase the OCR sooner rather than later if it still expects to start cutting the OCR later next year.

Regarding where the OCR should be in a year’s time, the Shadow Board’s core view ranged from 4.50 percent to 5.75 percent and centred on an OCR of 5.50 percent – a shift from 5.25 percent in the August NZIER Shadow Board. There was an increased view amongst members that another increase in the OCR may be required, given the stickiness of inflation and high inflation expectations. One member recommended that the Reserve Bank continue taking the wait-see-deliver approach for its monetary policy decisions over the next 12 months.

Figure 1 Shadow Board’s view on the OCR in a year’s time now centres on 5.50 percent

Source: NZIER Monetary Policy Shadow Board

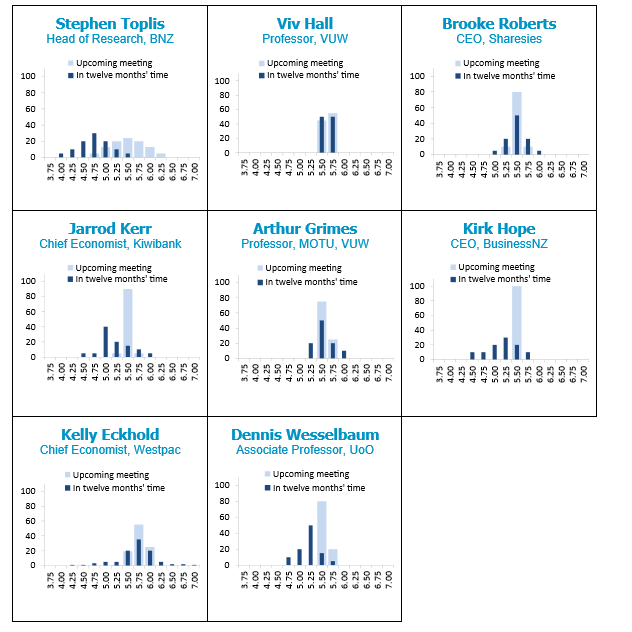

Figure 2 Individual participants’ recommended rate settings – 27 September 2023

Source: NZIER Monetary Policy Shadow Board

Table 1 Participant comments

| Stephen Toplis |

We strongly believe the RBNZ will leave the cash rate unchanged, but whether this turns out to have been the “right” thing to do is anyone’s guess. If the wheels fall off the economy, rates should have been lower. However, if inflation remains stubbornly high, it may turn out that interest rates should have been higher. |

| Viv Hall |

No comment. |

| Kirk Hope |

No comment. |

| Jarrod Kerr |

We believe the next move from the RBNZ will be a rate cut, but not until May 2024. The RBNZ will use the 12 months between interest rate movies to watch and wait, and then deliver. |

| Arthur Grimes |

No comment. |

| Kelly Eckhold |

Upside risks to inflation are crystallising, which increases my confidence that at least one rate increase will be required. An earlier rise in the OCR would likely bring forward when rate cuts could occur later next year. Otherwise, rates may not be cut next year. |

| Dennis Wesselbaum |

US inflation is down to about 3%, while our core inflation is stuck at 5.8%(ish). High inflation expectations might require another increase given that the OCR wasn’t hiked aggressively enough in the past (and ongoing debt-financed government spending). |

| Brooke Roberts |

No comment. |

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 27 November 2023, ahead of the RBNZ’s Monetary Policy Statement. Past releases are available from the NZIER website: www.nzier.org.nz.

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969