New Zealand Institute of Economic Research (Inc)

Media release

For release 10 am Monday, 21 November 2022

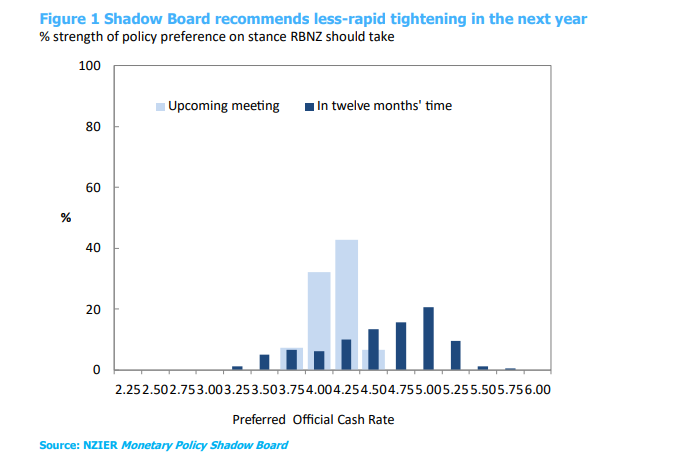

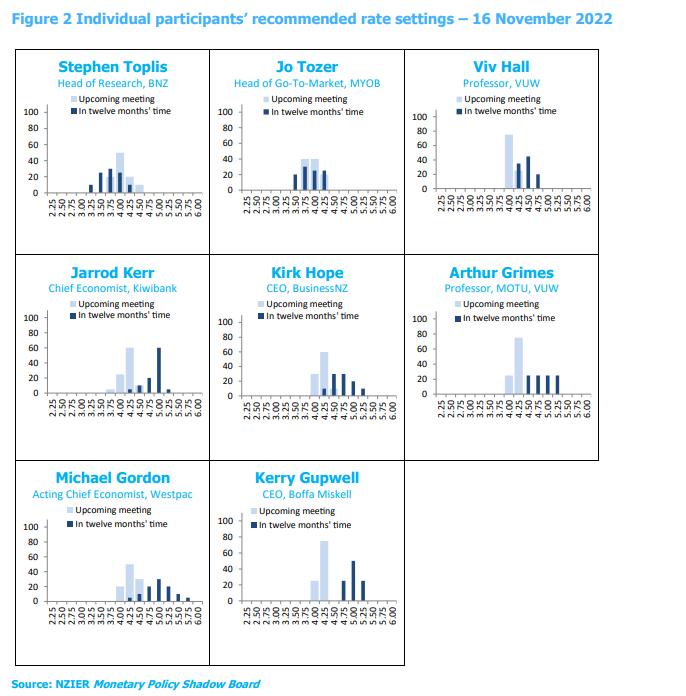

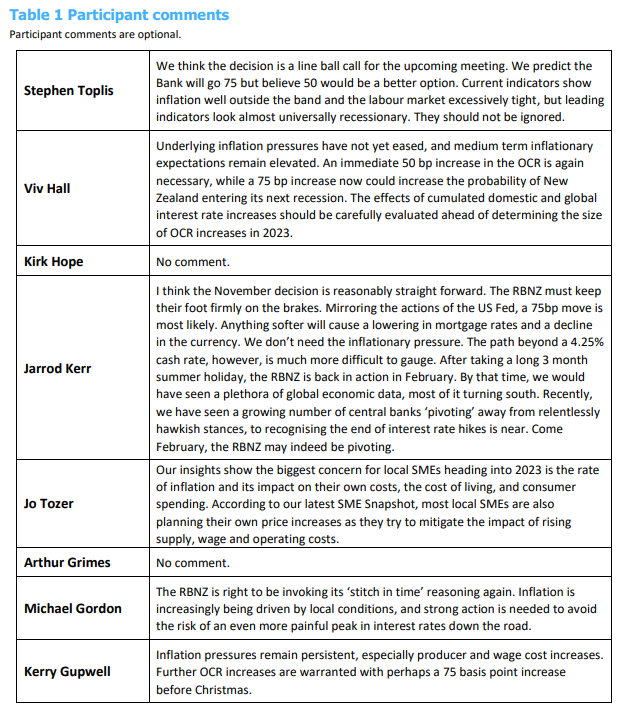

Shadow Board members recommend another hike in the Official Cash Rate (OCR) in the Reserve Bank’s upcoming November meeting. However, there was a range of views on the size of the increase. The majority view was that the OCR should increase by 75 basis points to 4.25 percent, given that strong action is required to bring down domestic inflation pressures. One member also considered that, given the rapid increase in the US Fed rate in recent months, any increases smaller than 75 basis points would weigh on the New Zealand currency and add to inflation pressures as prices of imported goods increase. Three members preferred a smaller OCR increase. Two of them highlighted the increased risk of entering another recession if the RBNZ increases the OCR by more than 50 basis points, and the other member was concerned about the increased costs for owners of SMEs.

Regarding where the OCR should be in a year, the Shadow Board’s core views ranged from 3.50 percent to 5.25 percent. One member noted that more central banks are increasing their interest rates at a less rapid pace now, and the Reserve Bank should take similar actions in the coming year. Some members pointed out that the Reserve Bank should consider the cumulative effect of interest rate increases on the New Zealand economy more carefully when determining the degree of tightening next year.

About the NZIER Monetary Policy Shadow Board

NZIER ’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 23 February 2023, ahead of the RBNZ’s Monetary Policy Statement.

Past releases are available from the NZIER website: www.nzier.org.nz

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969