NZIER’s QSBO shows improved business confidence and significant easing in labour shortages - Quarterly Survey of Business Opinion, October 2023

Media release, 3 October 2023

NZIER Quarterly Survey of Business Opinion

Embargoed until 10 am 3 October 2023

The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows business confidence improved further over the September quarter, although the sentiment is still generally downbeat. On a seasonally adjusted basis, a net 53 percent of businesses expect a worsening in general economic conditions over the coming months – down from 60 percent in the previous quarter.

Demand remains soft, with a net 17 percent of businesses reporting reduced activity in their own business in the September quarter. A net 14 percent also expect weaker demand in their own business in the next quarter.

Significant easing in labour shortages

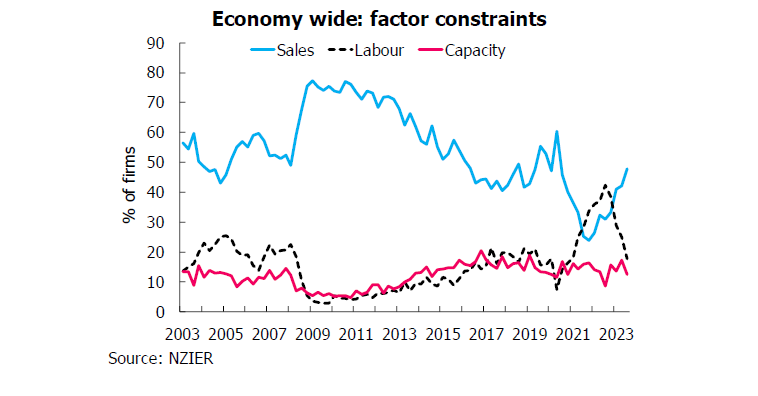

The most significant development in the September quarter survey has been the sharp easing in labour shortages. This is particularly the case for unskilled labour, with businesses now reporting it is easy to find unskilled labour. This is a turnaround from the same time last year when over half of businesses reported difficulty finding unskilled labour. Shortages of skilled labour also eased further, with a much lower proportion of businesses reporting difficulty finding skilled labour compared to a year ago. This easing in labour shortages is also reflected in the continued decline in the proportion of businesses reporting finding labour as the top primary constraint on their business, with softer demand now the primary concern for businesses.

These developments suggest that higher interest rates are starting to dampen demand in the New Zealand economy. Meanwhile, the strong recovery in net migration inflows since the reopening of international borders last year has helped to alleviate labour shortages as it enables firms to bring in workers from overseas. The combination of these factors has driven an easing in capacity pressures more broadly.

Pricing pressures have eased while cost pressures remain intense

Despite the easing in capacity pressures, businesses are still experiencing intense cost pressures, with only a slight decrease in the proportion reporting an increase in cost pressures in the September quarter. However, there has been some decrease in the proportion of businesses which raised prices over the quarter, suggesting an easing in pricing pressures. This softer demand environment seems to have reduced the ability of firms to pass on higher costs by raising prices.

Retailers are still the most downbeat

The retail sector remains the most downbeat across the sectors surveyed, with a net 66 percent of retailers surveyed expecting general economic conditions will deteriorate over the coming months. This pessimism reflects the weaker demand environment in the economy as households grapple with higher living costs and interest rates. Softer demand means retailers have been less able to raise their prices in the September quarter, while the proportion of retailers reporting higher costs also increased. With around half of mortgages in New Zealand due for repricing within 12 months’ time, many households will be refixing at much higher mortgage rates of around 7 percent or higher. We expect this significant increase in mortgage repayments will drive a further slowing in retail spending over the coming year, which should weigh on profitability for retailers.

Manufacturers are also feeling downbeat, with the proportion of manufacturers expecting a deterioration in the economic outlook staying at a level similar to the previous quarter. While fewer manufacturers report increased cost and pricing pressures, the weaker export demand has reduced hiring appetite amongst manufacturers. The building sector has also reduced hiring due to weaker demand, intense cost pressures and limited ability to raise prices. The weaker demand facing the building sector is reflected in the architects’ measure of work in their own office, which showed a continued decline in the pipeline of housing, commercial and Government construction work for the coming years.

The services sector is less pessimistic compared to the other sectors surveyed. Also, the proportion of services sector firms expecting weaker economic conditions over the coming months has also decreased from the level seen in the previous quarter. Hiring in the services sector remains robust despite reduced activity in the sector.

The upcoming general election is adding to businesses’ caution around investment

Businesses remain cautious when it comes to investing in buildings, plant and machinery over the coming year. The upcoming general election will also add to this caution amongst businesses, as the uncertainty over the election outcome means businesses tend to hold off on investment plans.

For further information, please contact:

Christina Leung

Principal Economist & Head of Membership Services

Ph +64 21 992 985 | Email christina.leung@nzier.org.nz

Background

The New Zealand Institute of Economic Research has conducted its Quarterly Survey of Business Opinion since 1961. It is New Zealand’s longest-running business opinion survey. Each quarter we ask around 4,300 firms about whether business conditions will deteriorate, stay the same, or improve. The responses yield information about business trends much faster than official statistics and act as valuable leading indicators about the future state of the New Zealand economy. Long term series derived from the survey are held at the NZIER and are available to NZIER members via our website at www.nzier.org.nz.

Share this

Related publications

NZIER’s QSBO shows a cut-back in optimism amongst businesses, Quarterly Survey of Business Opinion - October 2025

NZIER’s QSBO shows business confidence waning in the face of weak demand, Quarterly Survey of Business Opinion - April 2024