Shadow Board recommends no change to the OCR in July

New Zealand Institute of Economic Research (Inc)

Media Release, 10 am Monday, 10 July 2023

For immediate release

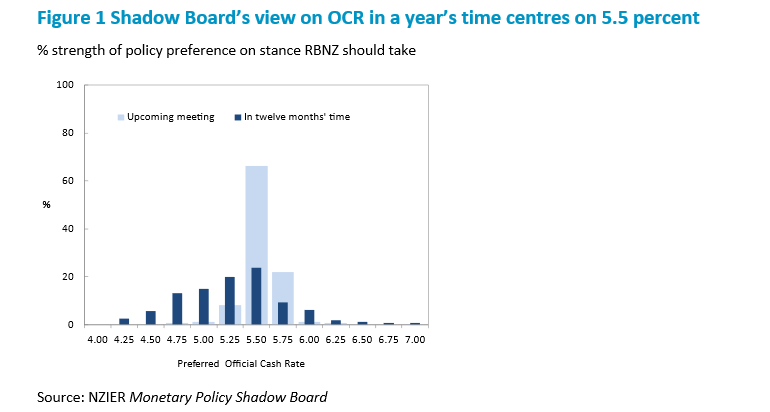

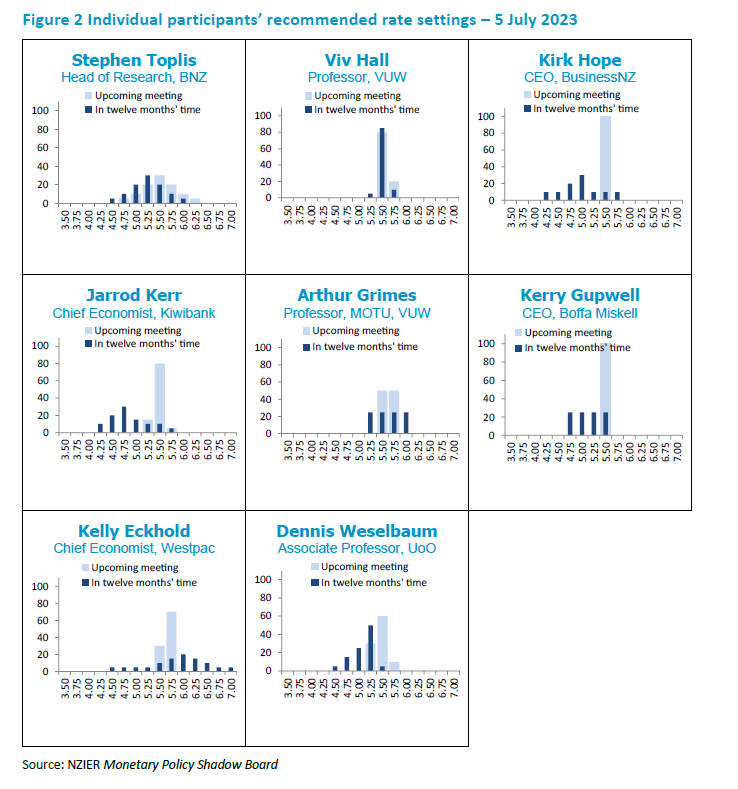

Most Shadow Board members recommend the Reserve Bank should keep the Official Cash Rate (OCR) at 5.50 percent in the upcoming July Monetary Policy Review. While inflation pressures are still high and the labour market remains strong, the slowing in demand and economic activity and expectations for previous OCR increases to work their way through the New Zealand economy warrant a hold on further tightening. However, one member recommended a 25-basis point increase, reflecting the view that inflation is sticky.

Regarding where the OCR should be in a year, the Shadow Board’s views ranged from 4.50 percent to 6 percent and centred on an OCR of 5.50 percent. This broadly reflects the view that the Reserve Bank should take a wait-and-see approach for further OCR actions, given there is a mix of factors that need to be considered carefully. With the previous OCR increases gaining more traction in dampening demand over the coming year, a further slowing in activity is expected in an already-downbeat economy. However, as one member pointed out, the higher-than-expected migration and increased Government spending will contribute to demand in the New Zealand economy, posing upside risks to inflation and interest rates. One member suggested that global interest rates will likely converge between 5 and 6 percent, given the stickiness of inflation, and New Zealand inflation will likely fall into this range in time. Nonetheless, the Reserve Bank should continue to evaluate the impact of previous OCR increases and economic developments for OCR decisions beyond July.

Table 1 Particpant comments

Participants comments are optional

| Stephen Toplis | The RBNZ is on hold. It’s now all a matter of wait and see. Risks are evenly spread on outcomes, but we still believe that the next appropriate move in rates is down, albeit some time away. |

| Viv Hall | A real-time technical recession is not automatically a recession, especially when national accounts estimates can be significantly revised, and employment continues above its maximum sustainable level. A further evaluation of current and projected effects of OCR increases to date is warranted, especially on core/non-tradables inflation. No change in the OCR for this round, and any further increase to be dependent on forthcoming data. |

| Kirk Hope | No comment. |

| Jarrod Kerr | The full impact of previous monetary policy tightening is still working its way through. Forty percent of mortgage holders are rolling off fixed rates over the next 6 months. On top of the rapid rise in interest rates, high rates of inflation have slashed household purchasing power, and falling house prices have dented confidence and the ‘wealth effect’. We’re forecasting a shallow recession over the second half of 2023. So, it will be a double-dip recession. |

| Arthur Grimes | No comment. |

| Kelly Eckhold | Global interest rates seem likely to converge in the 5-6 percent range as inflation is proving sticky. NZ rates will likely reflect these pressures in time. |

| Kerry Gupwell | It is difficult to believe that the OCR will increase given the RBNZ commentary at the last OCR announcement. It seems that inflation remains stubbornly high, well above target, migration is higher than expected and recent commentary on the housing market is suggesting prices have bottomed out – reduced supply and an increase in demand given expectations around interest rates. Employment remains high and the government continues to spend. People appear to be tightening their belts, there are increased concerns about business failures. Quite a mix of factors to consider and we are of course, in a recession of sorts. Therefore, my vote is a hold on any further increase for the moment. |

| Dennis Wesselbaum | GDP growth is zero (at best), income and job seeker support keep rising: OCR hikes have successfully slowed demand. Since the last OCR hikes will still come into effect with a lag, I would stop increasing the OCR. |

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 14 August 2023, ahead of the RBNZ’s Monetary Policy Statement. Past releases are available from the NZIER website: www.nzier.org.nz

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty.

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969

Share this

Related publications

Shadow Board recommends the Reserve Bank hold the OCR at 5.50 percent in October

Shadow Board recommends the OCR should remain at 5.5 percent in August