Shadow Board recommends no change to the OCR in November

New Zealand Institute of Economic Research (Inc)

Media Release, 10 am Monday, 27 November 2023

For immediate release

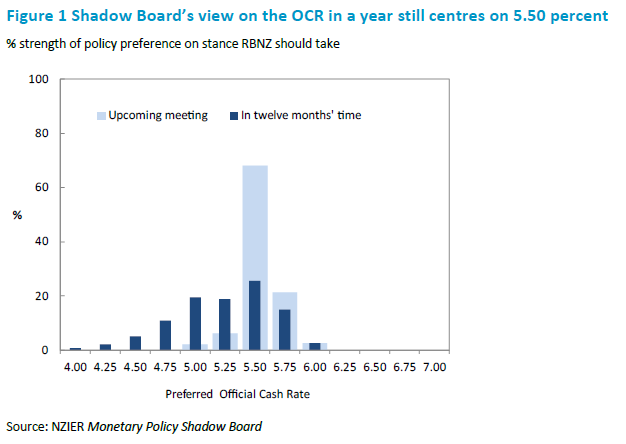

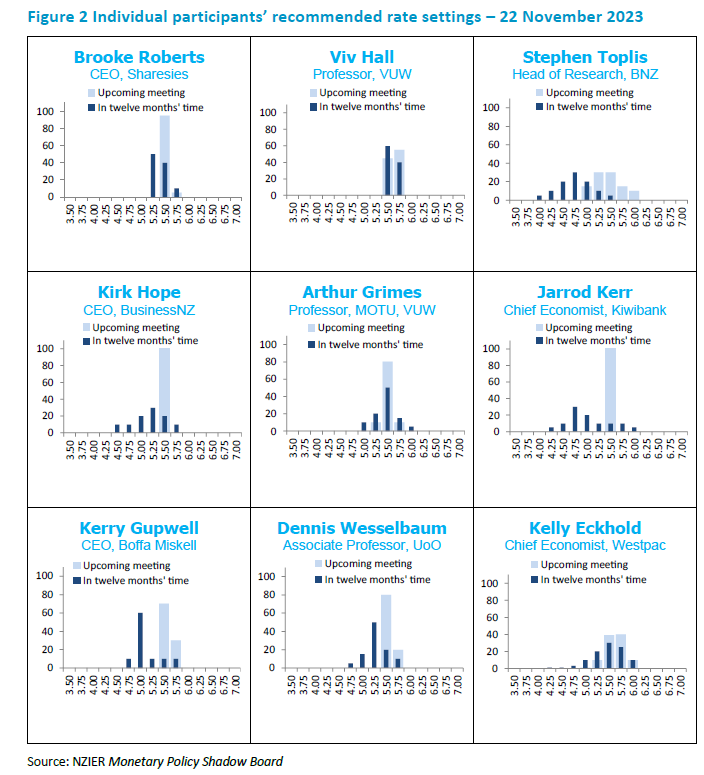

Most Shadow Board members recommended the Reserve Bank keep the Official Cash Rate (OCR) unchanged at 5.50 percent in the upcoming Monetary Policy Statement on 29 November. The impact of previous OCR increases is coming through as many households move onto much higher mortgage rates. The latest data also indicates an easing in inflation and labour market pressures. One member recommended the Reserve Bank should increase the OCR by 25 basis points, given inflation expectations and core inflation remain elevated.

Regarding where the OCR should be in a year’s time, the Shadow Board’s core view ranged from 4.50 percent to 5.75 percent and centred on 5.50 percent. Some members considered that recent developments in inflation and the labour market, along with the waves of mortgage refixing, provide the Reserve Bank with some comfort that the OCR increases to date would be enough to contain inflation back towards its 1 to 3 percent inflation target band. However, some members were concerned with high inflation expectations and the recent pick-up in housing market activity, which may increase the need for an OCR increase beyond 2023. Members considered it prudent for the Reserve Bank to take a cautious approach to see how these risks will play out for inflation.

Table 1 Participant comments

| Stephen Toplis | It would be a major surprise if the RBNZ didn’t leave rates on hold. However, inflation and labour market constraints are moving in the right direction, providing the RBNZ with license to ease as soon as it feels comfortable. |

| Viv Hall | Inflation expectations and core/non-tradables inflation remain stubbornly elevated, which justifies a further 25bp increase sooner rather than later. The balance of risks over the coming 12 months will depend heavily on what fiscal policy stance emerges. |

| Kirk Hope | No real fundamental change in key data that justifies any changes at this stage. |

| Jarrod Kerr | The RBNZ’s heavy hand hiking is feeding through. Most mortgage holders are on much higher rates, with only a few on the record low rates of 2021. Those 2-year fixed rates, fixed two years ago, are rolling off now. The labour market is clearly softening, with demand for labour easing as labour supply increases with migration. Inflation prints are coming in slightly below estimates. It’s ugly. But it’s progress. We can’t see the justification for further hikes. And it is still too early to call for cuts. Although we believe cuts will come. |

| Arthur Grimes | Given current uncertainties, the best short-term policy is probably “wait and see”. As inflation falls, a slightly longer-term easing bias is probably warranted. |

| Kelly Eckhold | Recent falls in some tradables prices have reduced upside headline inflation risks, leaving the RBNZ more space to keep rates close to current levels for a while. The strengthening housing market remains a key medium-term inflation concern and could see a need for higher rates later next year. Scope for rate cuts looks limited without a decisive move to lower core inflation. |

| Kerry Gupwell | There are upside risks to inflation, so another rate increase may be needed now to facilitate cuts in 2024. |

| Dennis Wesselbaum | Expectations are still far away from the target range. Hikes become more likely, but not this round. |

| Brooke Roberts |

|

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 26 February 2024, ahead of the RBNZ’s Monetary Policy Statement. Past releases are available from the NZIER website: www.nzier.org.nz.

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

• encourage informed debate on each interest rate decision

• help inform how a Board structure might operate

• explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969

Share this

Related publications

Shadow Board is in favour of lowering the OCR by 50 basis points in November

Shadow Board recommends the OCR should remain at 5.5 percent in August