Shadow Board overwhelmingly in favour of keeping the OCR on hold in April

The NZIER Monetary Policy Shadow Board recommends the Reserve Bank of New Zealand (RBNZ) keep the Official Cash Rate (OCR) at 5.50 percent in the upcoming Monetary Policy Review on 10 April 2024. Shadow Board members agreed that inflation was easing, but there was uncertainty over whether the pace of this easing would be enough to bring annual CPI inflation back within the inflation target band over the coming year. The general view was that it would be prudent for the central bank to wait to assess how the economy will track over the coming months, given uncertainty over the global growth outlook and the new Government’s priorities.

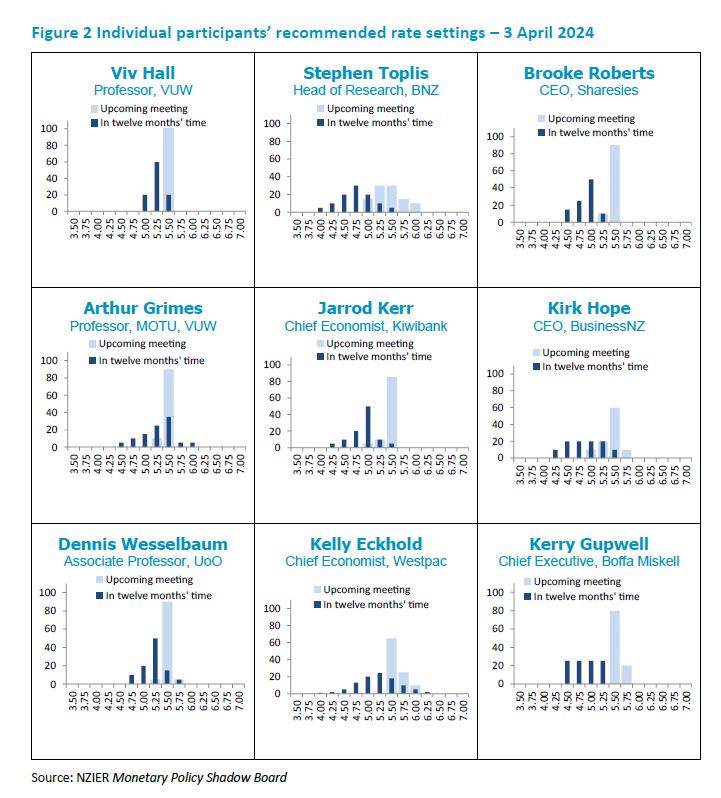

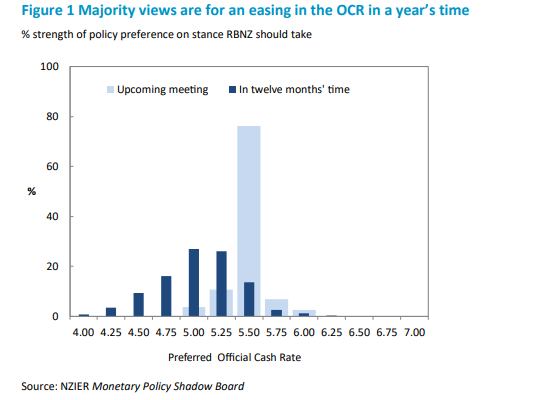

Regarding where the OCR should be in a year’s time, the Shadow Board’s view was that an easing would be appropriate, with the majority picking either 5 or 5.25 percent. This reflects broad agreement that inflation pressures in New Zealand are falling, which should provide scope for the RBNZ to lower the OCR. Most Shadow Board members highlight that a cautious approach is warranted, given some upside risks to the inflation outlook. This is broadly in line with our view that the RBNZ should start reducing the OCR from around the middle of next year.

Table 1 Participant comments

Participants' comments are optional

| Stephen Toplis | No comment. |

| Viv Hall | While it is pleasing to see headline CPI inflation being reduced somewhat, core/non-tradables inflation and inflationary expectations have still not declined sufficiently. The OCR should therefore, remain at 5.5% for some time yet. Global interest rate movements, New Zealand's May 30 Budget, and upside risks to non-tradables inflation could all have had a material influence on the OCR in 12 months’ time. |

| Kirk Hope | No comment. |

| Jarrod Kerr | We need to see another 2 or 3 inflation prints. We think inflation will fall below 3% in the September quarter. That data comes out in October. So, the earliest the RBNZ is likely to cut is November. And once they decide to cut, it’s not a 25bp decision; it’s a decision to move back to neutral ~3%. 2024 may be the year the RBNZ starts cutting. But 2025 will be the year they deliver the most. |

| Arthur Grimes | A wait-and-see approach with regard to how forecast inflation is tracking is still warranted in the short term. Longer term, reducing inflation pressures should imply some reduction in the OCR. |

| Kelly Eckhold | Inflation remains sticky, but the economy continues to operate well below trend. This should see enough evidence accumulate to justify rate cuts by April 2025. Key will be the extent of labour market adjustment – if that occurs rapidly, then easing towards the end of 2024 is feasible and lower rates by April 2025. However, there remains a significant risk that adjustment occurs more slowly, leaving inflation too high for too long. Hence higher rates in a year can’t be ruled out. |

| Dennis Wesselbaum | Lots of unknowns here (Q1 CPI, fiscal budget,…). On balance, inflation is coming down slowly (maybe a bit too slowly) and with zero growth, I don’t see reasons for changing the OCR in either direction. A cut might be coming a bit earlier than some might expect, though. |

| Brooke Roberts | No comment. |

| Kerry Gupwell | Large parts of the economy appear to be in pause mode as the coalition government works through its agenda and reset, this is impacting on short to medium term demand/work outlook for some sectors, which in turn is forcing some companies to look at their cost structures and pricing tactics. The public service sector is also under pressure. While inflation appears to be abating, domestic inflation remains under pressure, e.g. rents, rates and insurance. I don’t want to see a change in the OCR rate just now, but I can see cuts later in the year and in 2025. |

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 20 May 2024, ahead of the RBNZ’s Monetary Policy Statement. Past releases are available from the NZIER website: www.nzier.org.nz.

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Christina Leung,

Deputy Chief Executive (Auckland) & Head of Membership

christina.leung@nzier.org.nz, 021 992 985

Share this

Related publications

Shadow Board recommends the Reserve Bank cut the OCR by 25 basis points in May

Shadow Board recommends no change to the OCR in November