NZIER’s QSBO shows business confidence waning in the face of weak demand, Quarterly Survey of Business Opinion - April 2024

New Zealand Institute of Economic Research (Inc)

Media release, 9 April 2024

NZIER Quarterly Survey of Business Opinion

Embargoed until 10 am 9 April 2024

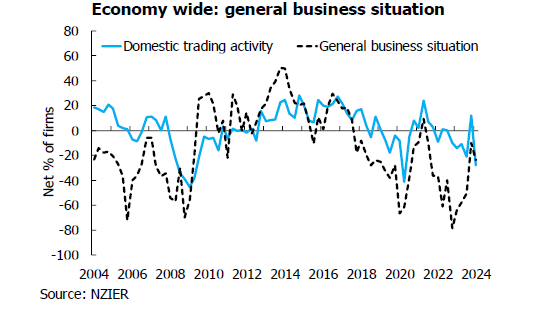

The latest NZIER Quarterly Survey of Business Opinion (QSBO) indicates the post-election bounce in business confidence and activity seen in the final quarter of last year was short-lived. A net 24 percent of businesses in the March quarter expect a deterioration in the general economic outlook over the coming months on a seasonally adjusted basis.

Firms’ own trading activity was similarly sobering, with a net 23 percent of firms reporting a decline in activity over the March quarter. This is a marked turnaround from the net 7 percent of businesses which had reported increased activity in the previous quarter. Overall, the results point to higher interest rates having their intended effects in dampening demand to reduce inflation pressures in the New Zealand economy. Uncertainty over the new Government’s plans regarding spending and public sector cutbacks is likely adding to the caution amongst businesses.

The building sector is now the most downbeat

While the pessimism was pervasive across the sectors, the building sector was particularly downbeat. A net 54 percent of building sector firms expect a deterioration in the general economic outlook, a significant turnaround from the net 8 percent of firms in the sector expecting an improvement in the previous quarter. With demand across housing, commercial and Government construction still weak, this is reducing pricing power for firms in the sector. Against the backdrop of intensifying costs, the construction sector faced a further deterioration in profitability in the March quarter.

Meanwhile, a quarter of retailers are feeling pessimistic about general economic conditions over the coming months. This reflects the effects of headwinds facing the household sector. With over half of mortgages due for repricing over the coming year, many households are likely to rein in discretionary spending in the face of significantly higher mortgage repayments and the softening of the labour market.

Confidence has also fallen in the services sector, with a net 22 percent of firms expecting a deterioration in the general economic outlook. Services sector firms are reducing staff numbers in the face of weaker demand. Interestingly, there has been a turnaround in interest rate expectations, particularly amongst financial services sector firms. A net 20 percent of financial services sector firms expect higher interest rates in a year’s time.

Weak construction demand is likely to be weighing on domestic demand in the manufacturing sector. A net 12 percent of manufacturers are feeling pessimistic about general economic conditions, as weak demand reduces pricing power in the sector.

Businesses cautious about hiring and investment

Weaker demand and uncertainty over the new Government’s plans for spending and cutbacks are likely key contributors to firms’ caution towards hiring and investment. A net 11 percent of firms reduced staff numbers in the March quarter, although hiring intentions for the next quarter are marginally positive.

The emerging optimism firms had felt in the previous quarter towards investment appears to have dissipated. A net 14 percent of firms plan to reduce investment in plant and machinery over the coming year, while a net 8 percent plan to reduce investment in buildings.

Cost and pricing pressures continue to ease

The decline in cost and pricing indicators suggests a further easing in inflation in the New Zealand economy. Higher interest rates look to have their intended impact on dampening demand and reducing inflation pressures. We forecast annual CPI inflation to ease back towards the Reserve Bank’s 1 to 3 percent inflation target band in the second half of this year. This should give the central bank enough confidence to begin reducing the OCR next year.

For further information, please contact:

Christina Leung

Deputy Chief Executive (Auckland) & Head of Membership Services

Ph +64 21 992 985 | Email christina.leung@nzier.org.nz

Background

The New Zealand Institute of Economic Research has conducted its Quarterly Survey of Business Opinion since 1961. It is New Zealand’s longest-running business opinion survey. Each quarter we ask around 4,300 firms about whether business conditions will deteriorate, stay the same, or improve. The responses yield information about business trends much faster than official statistics and act as valuable leading indicators about the future state of the New Zealand economy. Long term series derived from the survey are held at the NZIER and are available to NZIER members via our website at www.nzier.org.nz.

Share this

Related publications

NZIER’s QSBO shows continued lift in business confidence, Quarterly Survey of Business Opinion - April 2025

NZIER’s QSBO shows a cut-back in optimism amongst businesses, Quarterly Survey of Business Opinion - October 2025