Shadow Board calls for substantial tightening over the coming year

The Shadow Board is calling for a sharp increase in the official cash rate (OCR) over the coming year in the face of intensifying inflation pressures.

New Zealand Institute of Economic Research (Inc)

Media release

For release 10 am Monday, 21 February 2022

The Shadow Board is calling for a sharp increase in the official cash rate (OCR) over the coming year in the face of intensifying inflation pressures. There was an overwhelming call for the OCR to be increased by 25 basis points to 1 percent at the upcoming meeting, with some appetite for a 50 basis points OCR increase. Beyond the February meeting, there was a wider range in views of how high the OCR needs to go in twelve months’ time.

Inflation pressures have continued to intensify, reflecting continued supply constraints from global supply chain disruptions and port congestion, as well as acute labour shortages. There is also the risk of further disruptions to supply as the widening spread in the Omicron COVID-19 outbreak leads to workers having to stay home due to illness or self-isolation. These supply constraints are driving up costs, with resilient demand allowing businesses to pass higher costs on by raising prices.

Shadow Board members point to the sharp rise in the annual Consumers Price Index (CPI) to 5.9 percent for the year to December 2021, with expectations of a further pick-up in inflation over the coming year. Despite heightened uncertainty over how the COVID-19 outbreak will evolve both here and abroad, the need to dampen inflation pressures is the dominant influence amongst Shadow Board members in the call for lifting the OCR from current low levels.

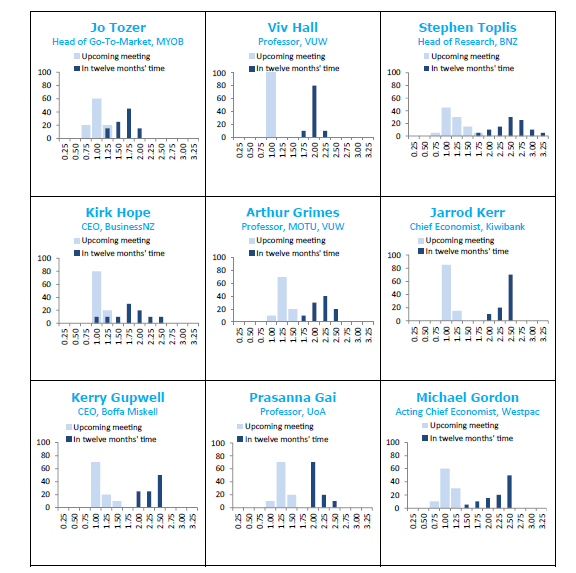

Figure 1 Calls for substantially higher OCR over the coming year

% strength of policy preference on stance RBNZ should take

Source: NZIER Monetary Policy Shadow Board

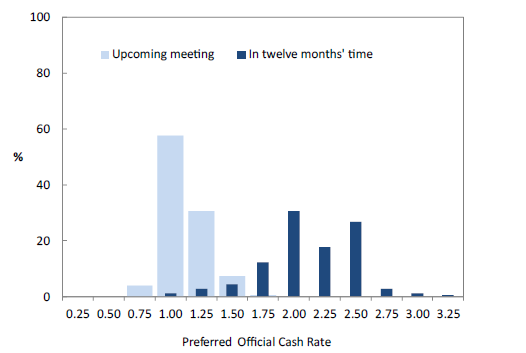

Figure 2 Individual participants’ recommended rate settings –16 February 2022

Source: NZIER Monetary Policy Shadow Board

Table 1 Participant comments

Participant comments are optional

| Stephen Toplis | Clearly the OCR has to rise and rise a fair bit. The only questions are how fast and where does it all end? The balance of risk around our expectations is that rates need to be higher, faster but the corollary to this is that they might then be able to, ultimately, fall faster as their impact bites. The problem for the RBNZ is preventing another massive supply-side shock (Omicron), generating persistent inflation at a time when there is already excess demand. |

| Viv Hall | Actual and projected domestic and global inflationary pressures outweigh Omicron and other risks to real sector outcomes. Another 25 bp increase in the OCR is required immediately and should be followed by further measured increases for as long as inflationary pressures dominate. |

| Kirk Hope | No comment. |

| Jarrod Kerr | At 5.9%, inflation is running at nearly double the top of the RBNZ’s 1-to-3% target band, or triple the mid-point. Importantly, core measures of inflation are running around 5%. On the other side of the mandate, unemployment is at a historic low of just 3.2%, and wages are rising. We expect the RBNZ to tighten policy, taking the cash rate well above the perceived neutral rate of 2%, with a forecast cash rate of 2.5% by year-end. |

| Jo Tozer | With inflation reaching record levels in the last quarter and a large number of businesses intending to raise prices in 2022 (44% of SMEs in our last poll, 85% of mid-market businesses), the RBNZ will need to increase the OCR. However, they must be mindful of the continued squeeze on local businesses, who now face supply disruptions, rising finance and wage costs, and uncertain demand. |

| Kerry Gupwell | Full employment, supply-side constraints and aspects of government policy would suggest ongoing inflationary pressures that will need to be tamed in part through an increase in the OCR; the question is how hard and how early? |

| Arthur Grimes | No comment. |

| Michael Gordon | The RBNZ needs to take the heat out of domestic demand to rein in inflation pressures, and a key channel for that will be via the housing market. Mortgage rates have already risen in anticipation of OCR hikes, and this is clearly having the desired effect. But to finish the job, the RBNZ will need to follow through on those hikes. |

| Prasannai Gai | No comment. |

About the NZIER Monetary Policy Shadow Board

NZIER’sMonetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 11 April 2022, ahead of the RBNZ’sMonetary Policy Review. Past releases are available from the NZIER website: www.nzier.org.nz

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

- encourage informed debate on each interest rate decision

- help inform how a Board structure might operate

- explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Christina Leung, Principal Economist & Head of Membership Services

christina.leung@nzier.org.nz, 021 992 985

Share this

Related publications

Shadow Board is divided over whether the RBNZ should hike by 50bp

NZIER’s Shadow Board calls for tightening at the upcoming meeting