Shadow Board recommends the Reserve Bank should keep the OCR on hold in February

New Zealand Institute of Economic Research (Inc)

Media Release, 10 am Monday, 26 February 2024

For immediate release

The NZIER Monetary Policy Shadow Board recommends the Reserve Bank of New Zealand (RBNZ) keep the Official Cash Rate (OCR) at 5.50 percent in the upcoming Monetary Policy Statement on 28 February 2024. The continued easing in the labour market, annual CPI inflation and the slowing in GDP growth suggest that the OCR increases to date are having the dampening effect on the New Zealand economy as the RBNZ intended. Several members pointed out that it is too soon to consider decreasing the OCR, given that domestic inflation pressures remain elevated.

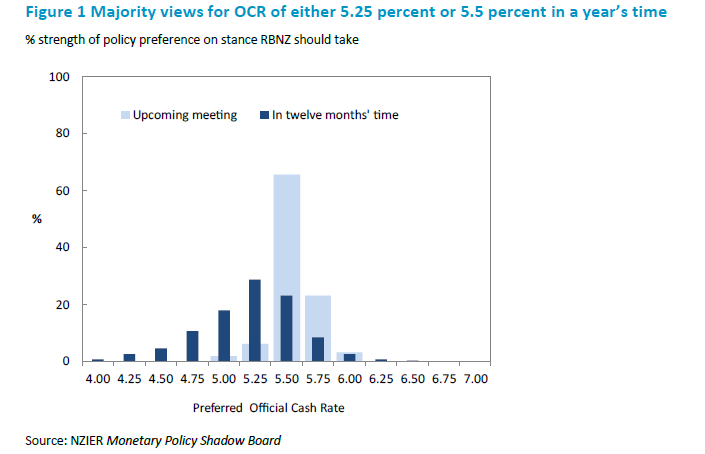

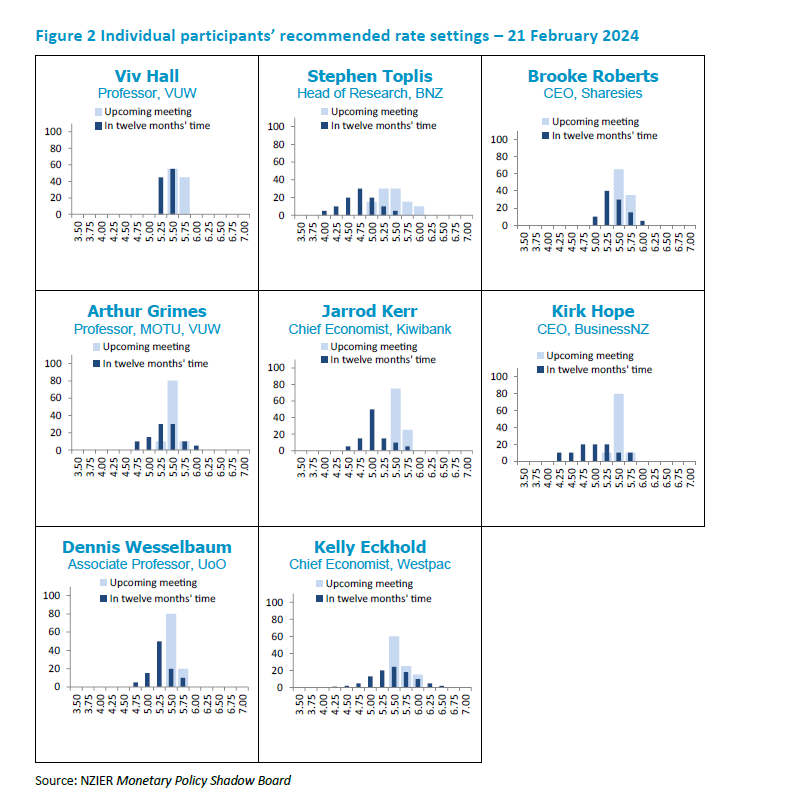

Regarding where the OCR should be in a year’s time, the Shadow Board’s core view ranged from 4.75 percent to 5.75 percent, with the majority picking either 5.25 percent or 5.50 percent. The broad consensus was that the RBNZ should not lower the OCR any time soon in order for inflation to sufficiently come down and stabilise within its 1 to 3 percent inflation target band. Two members also stressed that the RBNZ should continue to take a conservative approach in the coming year to allow time to see how any risks to inflation play out. The members’ views are broadly in line with our view that the OCR should remain at or near the current restrictive level over the coming year.

Table 1 Participant comments

Participants' comments are optional

| Stephen Toplis | Our views are unchanged from November. We believe there is little justification for any rate increase and that the combination of a moribund economy, rapidly easing labour market, falling inflation (headline and core) and well contained inflation expectations suggest lower interest rates would be appropriate. Nonetheless, it is clear the cash rate will not be lowered any time soon. |

| Viv Hall | While headline inflation and inflation expectations have eased somewhat, non-tradables inflation, inflation expectations and pricing intentions have not come down sufficiently. Due consideration is given to the effects of domestic and global OCR increases to date, and to considerable upside and downside uncertainties. Overall, not a strong enough case for any OCR easing for a considerable time yet. |

| Kirk Hope | No comment. |

| Jarrod Kerr | It’s all about inflation globally. The fight to contain inflationary pressures is ongoing. But the war is being won. There are just a few battles to go. Measures of core inflation and inflation expectations have improved markedly. The economy has cooled, and inflation should drop back within the RBNZ’s target band later in the year and head to 2 percent early next year. Also, the RBNZ should take some comfort in the latest expectations survey. Inflation has eased, and expectations of future inflation have eased as well. It is self-reinforcing. Enough is enough. There is no need to hike again. But that is the risk. |

| Arthur Grimes | It is too early (and too uncertain) to increase or decrease rates at present. Longer term, the influence of declining global inflation should lead to a slight easing trend. |

| Kelly Eckhold | The resilient labour market and sticky core inflation will have the RBNZ on edge and could see them move the OCR up if they lose their nerve. More likely, they will allow time to see more data and reserve the decision to take the OCR higher until mid-year – by which time it should be clearer that the inflation target range is within reach. Keeping the OCR unchanged in 2024 and gradually moving lower from early 2025 remains the most likely outcome. |

| Dennis Wesselbaum | “Domestic” inflation and inflation expectations are way too high given the duration of contractionary monetary policy. However, unemployment is up, jobseeker support is up, GDP growth is low, and the new government promises fiscal policy changes (read Sargent’s “The Ends of Four Big Inflations”). Maybe not acting is the best course of action. |

| Brooke Roberts | This seems a rather contentious announcement, with economists splitting on the views of an impending increase or maintaining the OCR at 5.5 percent. We are anticipating a lean (65%) towards maintaining 5.5% without ruling out the chance of a 0.25% OCR hike (35%). We are seeing inflation cooling from 5.6% in the third quarter to 4.7% in the three months to December 2023. New Zealand also has around $200b in mortgages set to refinance this year, meaning impacts of the current OCR settings are still to roll through for many. However, as core inflation is sticky and the Reserve Bank is focused on the 2 percent midpoint, there is still an argument to point to a hike next week. With Adrian Orr stating at the NZ Economic Forum ‘whilst inflation coming down… we’re not there yet… and next period will be difficult as we need to anchor to that 2% inflation’. |

About the NZIER Monetary Policy Shadow Board

NZIER’s Monetary Policy Shadow Board is independent of the Reserve Bank of New Zealand. Individuals’ views are their own, not those of their respective organisations. The next Shadow Board release will be Monday, 8 April, ahead of the RBNZ’s Monetary Policy Review. Past releases are available from the NZIER website: www.nzier.org.nz.

Shadow Board participants put a percentage preference on each policy action. Combined, the average of these preferences forms a Shadow Board view ahead of each monetary policy decision.

The NZIER Monetary Policy Shadow Board aims to:

• encourage informed debate on each interest rate decision

• help inform how a Board structure might operate

• explore how Board members could use probabilities to express uncertainty.

For further information, please contact:

Ting Huang, Senior Economist

ting.huang@nzier.org.nz, 027 266 0969

Share this

Related publications

Shadow Board recommends that the Reserve Bank keep the OCR on hold in February

Shadow Board recommends an OCR cut of 25 basis points in April