New Zealand Institute of Economic Research (Inc)

Media release, 5 July 2022

NZIER Quarterly Survey of Business Opinion

Embargoed until 10 am 5 July 2022

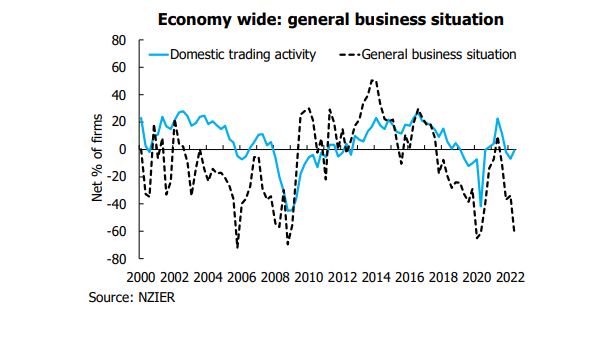

The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows that businesses are feeling more downbeat in the June quarter, with business confidence at its weakest level since March 2020. Economic activity in the March quarter had been negatively affected by the acceleration in COVID-19 cases as people stayed at home either as a result of self-isolation or infection. For the June quarter, firms saw activity in their own business remaining subdued. Besides the continued uncertainty over the COVID-19 outbreak, businesses are also grappling with the intensification of cost pressures and higher interest rates.

A net 1 percent of businesses reported a decline in their own trading activity in the June quarter on a seasonally adjusted basis. Meanwhile, a net 62 percent of businesses expect a deterioration in general economic conditions over the coming months – a marked increase from the net 34 percent of businesses who felt pessimistic in the previous quarter.

The services and building sectors were the most downbeat

The services and building sectors were most downbeat in the June quarter. a net 71 percent of services sector firms and net 70 percent of building sector firms expect a worsening in conditions. for both these sectors, it is a turnaround from the optimistic mood amongst these firms a year ago.

Despite the solid pipeline of construction work, the building sector is facing acute capacity constraints stemming from a shortage of workers and materials. this is underpinning strong cost pressures, but the proportion of firms who were able to raise prices has fallen. this is putting a further squeeze on operating margins. finding labour and materials are the primary constraints for building sector firms, with a sharp rise in the proportion of firms reporting their stocks of raw materials as being too low.

Although the pipeline of construction work is currently solid, there are emerging signs of an easing in demand, with a decline in architects’ reported activity in housing construction work. in contrast, the pipeline of government construction work has rebounded strongly, while there has been a slight pick-up in the pipeline of commercial construction work.

The services sector is also feeling much more downbeat, as increased expectations of further interest rate increases drive expectations of weaker demand ahead. while more services sector firms are facing higher costs, more have been able to pass this on by raising fees and prices.

Meanwhile, retailers are also feeling downbeat, with a net 61 percent of retailers expecting a worsening in general economic conditions over the coming months. cost pressures remain extremely high in the sector, with 96 percent of retailers reporting higher costs in the June quarter, while all retailers surveyed expect costs to increase in the next quarter. this is driving a continued deterioration in profitability in the retail sector. mortgage rates have risen sharply in recent months, and this, along with higher living costs, have weighed on consumer confidence. these factors will likely see households pare back on discretionary spending over the coming year.

Inflation pressures intensify further

Despite the shakier outlook for the New Zealand economy, inflation pressures have continued to intensify. more firms are facing increased costs, which are being passed onto customers in the form of higher prices. nonetheless, overall profitability amongst the firms surveyed remains weak.

Businesses continue to pare back on investment

Businesses are continuing to pare back on investment plans in the face of uncertainty over the continued impact of the covid-19 outbreak, geopolitical tensions abroad and higher interest rates. a net 15 percent of businesses plan to reduce investment in buildings, while a net 13 percent plan to reduce investment in plant and machinery. this continued weakening in investment intentions points to a slowing in business investment over the coming year.

For further information, please contact:

Christina Leung

Principal Economist & Head of Membership Services

Ph +64 21 992 985 | Email christina.leung@nzier.org.nz

Background

The New Zealand Institute of Economic Research has conducted its Quarterly Survey of Business Opinion since 1961. It is New Zealand’s longest-running business opinion survey. Each quarter we ask around 4,300 firms about whether business conditions will deteriorate, stay the same, or improve. The responses yield information about business trends much faster than official statistics and act as valuable leading indicators about the future state of the New Zealand economy. Long term series derived from the survey are held at the NZIER and are available to NZIER members via our website at www.nzier.org.nz.

Share this

Related news